TOKYO KEIKI INC. (TSE:7721) shares have had a horrible month, losing 30% after a relatively good period beforehand. Longer-term shareholders will rue the drop in the share price, since it’s now virtually flat for the year after a promising few quarters.

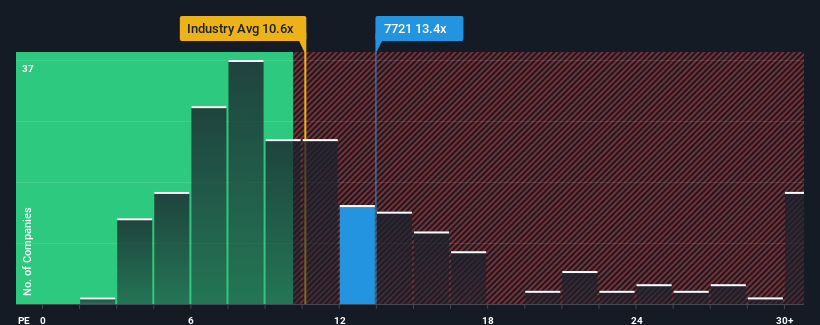

Although its price has dipped substantially, there still wouldn’t be many who think TOKYO KEIKI’s price-to-earnings (or “P/E”) ratio of 13.4x is worth a mention when the median P/E in Japan is similar at about 12x. Although, it’s not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We’ve found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Recent times have been advantageous for TOKYO KEIKI as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you’d be hoping this isn’t the case so that you could potentially pick up some stock while it’s not quite in favour.

See our latest analysis for TOKYO KEIKI

TSE:7721 Price to Earnings Ratio vs Industry April 7th 2025 If you’d like to see what analysts are forecasting going forward, you should check out our free report on TOKYO KEIKI . Does Growth Match The P/E?

TSE:7721 Price to Earnings Ratio vs Industry April 7th 2025 If you’d like to see what analysts are forecasting going forward, you should check out our free report on TOKYO KEIKI . Does Growth Match The P/E?

In order to justify its P/E ratio, TOKYO KEIKI would need to produce growth that’s similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 164%. The latest three year period has also seen an excellent 94% overall rise in EPS, aided by its short-term performance. Therefore, it’s fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 12% each year as estimated by the four analysts watching the company. That’s shaping up to be similar to the 9.7% each year growth forecast for the broader market.

With this information, we can see why TOKYO KEIKI is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

TOKYO KEIKI’s plummeting stock price has brought its P/E right back to the rest of the market. It’s argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of TOKYO KEIKI’s analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn’t great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

It’s always necessary to consider the ever-present spectre of investment risk. We’ve identified 1 warning sign with TOKYO KEIKI , and understanding should be part of your investment process.

Of course, you might also be able to find a better stock than TOKYO KEIKI. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we’re here to simplify it.

Discover if TOKYO KEIKI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

AloJapan.com